ri tax rate income

Any income over 150550 would be. Detailed Rhode Island state income tax rates and brackets are available on.

Here S How Your State Measures Up On Taxes The Motley Fool

Rhode Island also has a 700 percent corporate income tax rate.

. Each tax bracket corresponds to an income range. Rhode Island Income Tax Rate 2022 - 2023. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. Rhode Island Tax Table. Rhode Island Tax Brackets for Tax Year 2021.

If you make 120000 a year living in the region of Rhode Island USA you will be taxed 26200. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. DO NOT use to figure your Rhode Island tax.

To calculate the Rhode Island taxable income the statute starts with Federal taxable income. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Rhode Island has a.

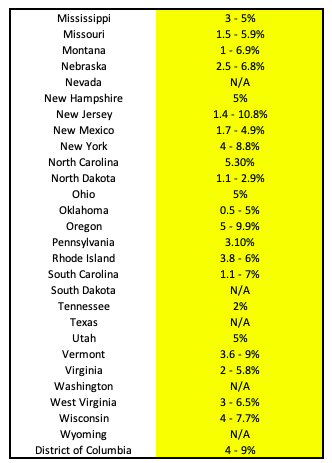

Census Bureau Number of cities that have local income taxes. The table below shows the income tax rates in Rhode Island for all filing statuses. Personal income tax rates 2017 State Tax rates Number of brackets Brackets Lowest.

DO NOT use to figure your Rhode Island tax. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of.

Rhode Island Income Tax Calculator 2021. Compare your take home after tax and estimate. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. In 2011 Rhode Islands tax system underwent the most sweeping changes since the state tax was enacted in 1971.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. 34 cents per gallon of regular gasoline and diesel. The range where your annual income.

Like most other states in the Northeast Rhode Island has. Rhode Island income tax rate. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax.

Most notable was the reduction of. How Your Rhode Island Paycheck. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599. Residents and nonresidents including resident and. The table below summarizes personal income tax rates for Rhode Island and neighboring states in 2017.

Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023. Your average tax rate is 1198 and your. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Personal income tax. 153 average effective rate.

Instead if your taxable income.

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

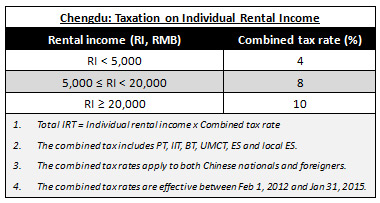

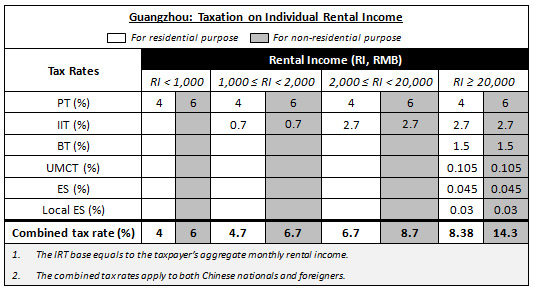

Taxation On Real Estate Rental Income In China China Briefing News

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

The Individual State Income Tax Rate For Every State For 2016 Chart Atlanta Business Chronicle

Rhode Island Income Tax Rate And Ri Tax Brackets 2022 2023

Which States Pay The Highest Income Tax Washington Examiner

Taxation On Real Estate Rental Income In China China Briefing News

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Greater Providence Chamber Of Commerce Our Top 10 Reasons Why Now S Not The Time For A 50 Tax Hike On Rhode Islanders Any Increase In Personal Income Tax Rates Would Adversely

Rhode Island Income Tax Calculator Smartasset

Prepare And Efile Your 2021 2022 Rhode Island Tax Return

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

General Sales Taxes And Gross Receipts Taxes Urban Institute

How Illinois Income Tax Stacks Up Nationally For Earners Making 100k Center For Illinois Politics

17 States With Estate Taxes Or Inheritance Taxes

States With The Highest Lowest Tax Rates

Top Personal Income Tax Pit Rates In The 50 States In 2004 And 2005 Download Table

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute